As loan apps fade from the spotlight, a new wave of stock investment apps is emerging, ready to ensnare unsuspecting users. Often part of a massive scam, these apps are designed to siphon millions from the public, posing a significant threat.

Stock scams are a chilling new trend in digital financial crime. Like a predator stalking its prey, scammers build relationships with their victims only to pounce and steal substantial amounts of money. They target middle-aged adults, mainly those aged 35 to 60, who may be less tech-savvy but possess substantial financial resources, making them prime targets for these scams. Recent cases have seen individuals lose millions, a stark reminder of the dangers of trust and technology.

Recent cases of stock investment scams have left a trail of financial devastation. A doctor lost a staggering Rs. 2.5 crores, a retired mechanical engineer lost Rs. 3.95 crores, a president of a private finance company lost Rs. 3.5 crores, a private firm manager lost Rs. 1.62 crores, a retired bank manager lost Rs. 90 lakhs, and a 49-year-old businessman lost Rs. 42 lakhs. Another case involved a man from Kolkata who lost Rs. 20 lakhs, further highlighting the widespread nature of this issue. These are not just numbers, but the hard-earned savings of individuals who fell victim to these scams.

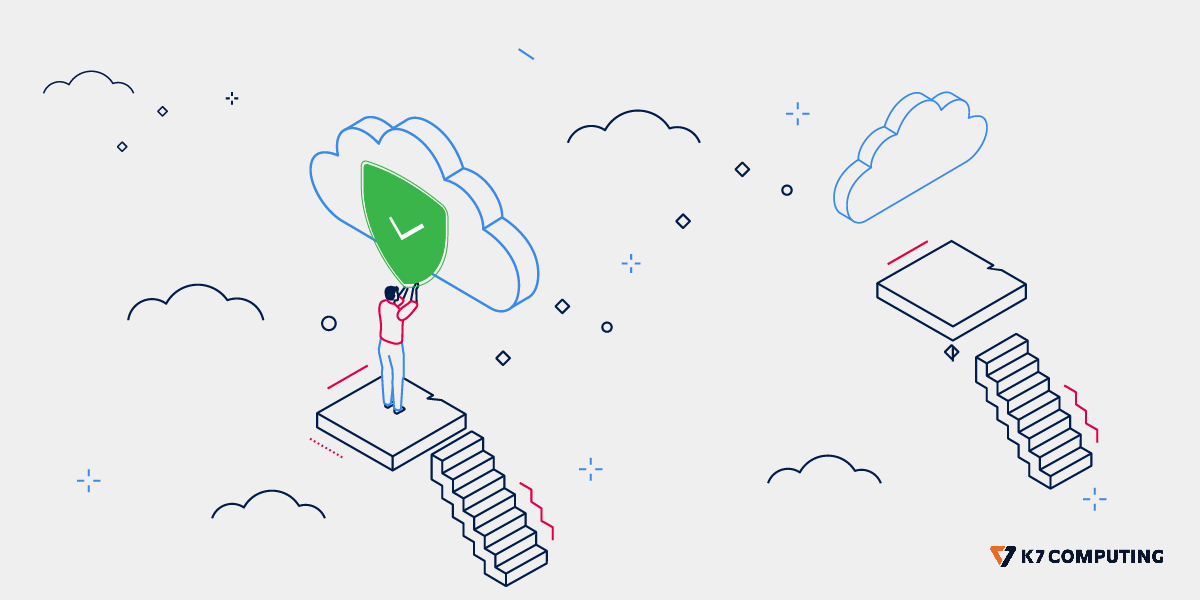

How Stock Investment Scams Unfolds

Social media and instant messaging platforms have become the hunting grounds for stock investment scams. Platforms like Instagram, Facebook, WhatsApp, Telegram, Twitter, and YouTube teem with fraudsters who pose as successful traders or financial advisors.

They gradually build trust through constant communication. Over weeks or months, these scammers convince their targets of a can’t-miss investment opportunity in potential stocks and initial public offerings (IPO). The victims are then directed to legitimate-looking but fraudulent websites, where the successive investments are coerced with time. The victims are gradually lured into investing more money, often showing fake returns to validate how much “success” their investment has brought—the commencement of another cycle of more investment until the scammer runs away with the accumulated funds. The consequences can be devastating, as recent cases have shown individuals losing millions, a stark reminder of the dangers of trust and technology.

A process chart displaying how Investment Scam works

The Role of Social Media and Messaging Platforms

Scammers adeptly use platforms like WhatsApp, Telegram, Instagram, and Facebook to create elaborate personas or infiltrate community groups to initiate contact and build trust. They create fake profiles and even entire social circles that simulate a real community of investors. Specific to WhatsApp and Telegram, scammers often set up or infiltrate groups to disseminate positive testimonials about fake investments, pushing members to invest increasingly more significant amounts. These groups are usually peppered with counterfeit testimonials and manipulated success stories to encourage further investments.

Usually, they put up fake WhatsApp and Telegram groups with other fraud accounts, making it seem like the community is made up of real people to falsely reassure the victims regarding the genuineness and potential of the offered investment opportunities.

The Role of Deepfake Technology

Deepfake, like other AI technology platforms, allows scammers to create convincing content to attract and deceive victims.

Such elaboration may include fake video messages of reputed investors or testimonials of some celebrities, which are crafted through different deepfake apps to legitimize their self-made scams. These can consist of fabricated endorsements from trusted public figures or financial experts, making the scams appear legitimate and more challenging to question. Therefore, the victim is given the false impression that the information is accurate and that they will make a real investment.

If you’re socially aware, you might have seen fake promotions in which Ratan Tata and Narayan Murthy vouch for some stock trading platforms.

Luring High-Worth Individuals

High-net-worth individuals are desirable targets for these scammers. In recent months, we have seen several cases where the victim was offered a free one-to-one educational course on stock market investments and financial strategies, most often provided free. Such courses are presented as one-in-a-lifetime opportunities, backed by thorough and convincing material to draw these investors to put large sums into the scam.

Safeguards Against Stock Investment Scams

Prevention and education are vital in combating stock investment scams. Potential investors should:

- Verify and Validate: Always confirm the legitimacy of any investment opportunity through independent verification of the involved parties and platforms.

- Seek independent advice: Consult a financial advisor or trusted expert before investing.

- Educate on Social Engineering: Awareness programs should highlight the nature of social engineering and teach individuals how to recognize and resist emotional manipulations online.

- Be wary of pressure tactics: Legitimate investments do not require immediate and secretive actions.

- Social media interactions: Education on the need to exercise caution when receiving financial advice or investment opportunities on social platforms.

- Critical Evaluation of Media: Develop skills to critically evaluate the authenticity of digital content, mainly when it involves celebrity endorsements or professional advice on significant financial decisions. Always ensure any endorsement purporting from a celebrity is used through official channels or made directly by the public figure.

- Secure Communications: To protect against unauthorized access, implement robust cybersecurity measures, such as two-factor authentication, on all social and financial accounts.

- Authentic Apps: Always trust official app stores when downloading apps. An extra yet essential layer of security, such as K7 Mobile Security, safeguards you from falling prey to most digital threats.

Remember, these safeguards are theoretical and practical tools that can empower you to protect your financial resources.